Completing your Canopy tax organizer is easy to do by following the steps that we have laid out for you with easy-to-follow instructions below.

Tax forms are arriving in the mail, and by now, you have received your Witts CPA PC Tax Organizer by email.

We know how daunting it may feel to gather your documents, but this process doesn’t have to feel like a chore.

The updated tax organizer that we have put together for you has made this process easier than ever, with a simplified system of asking you tax questions geared to your tax needs before prompting you to attach your appropriate documents.

It is very important that you answer all of the questions in the organizer, and attach all of your documents, as these help your PWCPA PC accountant to understand any changes that have occurred and which taxes or deductions may apply this year.

Here are some easy steps to follow when completing your tax organizer.

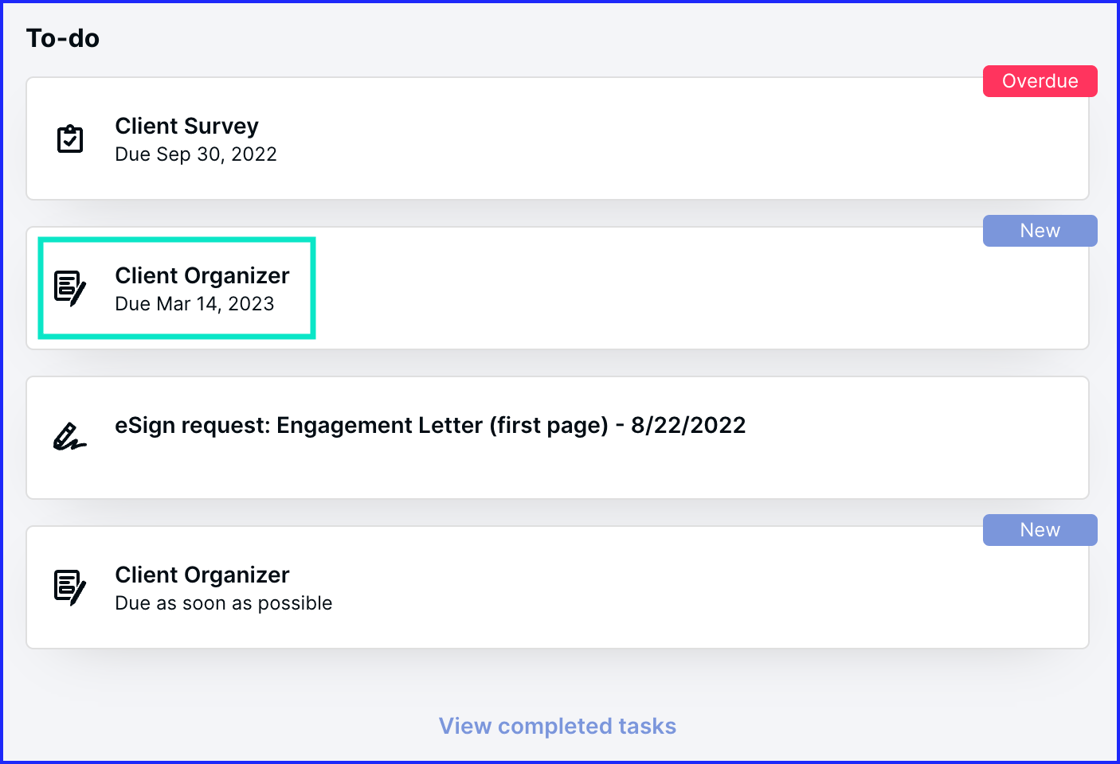

Organizers are visible on your To-do list in your Customer Client Portal and are indicated by a paper and pencil icon.

|

|

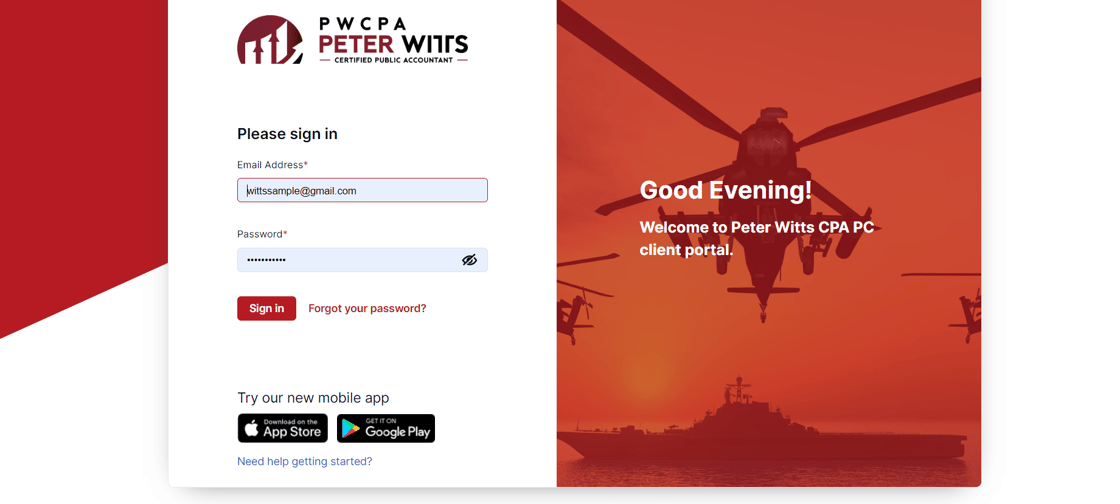

You will also have an email in your inbox from us, with a link to begin filling out your Organizer. To get started, log in to your Client Portal.

|

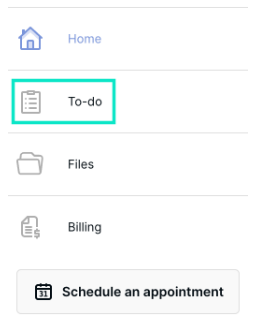

First select the To-do list tab.

|

Next, select a relevant Organizer on the to-do list.

|

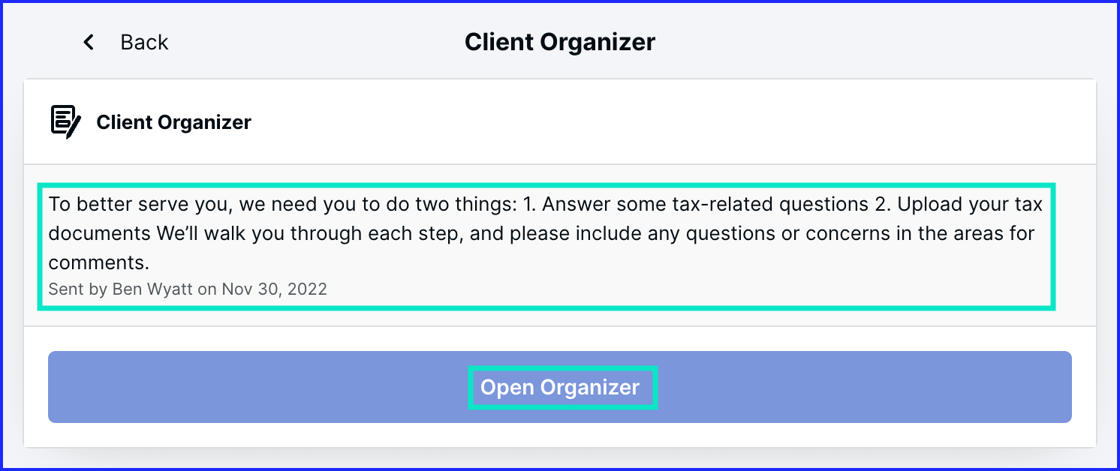

Read through the instructions and gather the needed materials. Click Open Organizer.

|

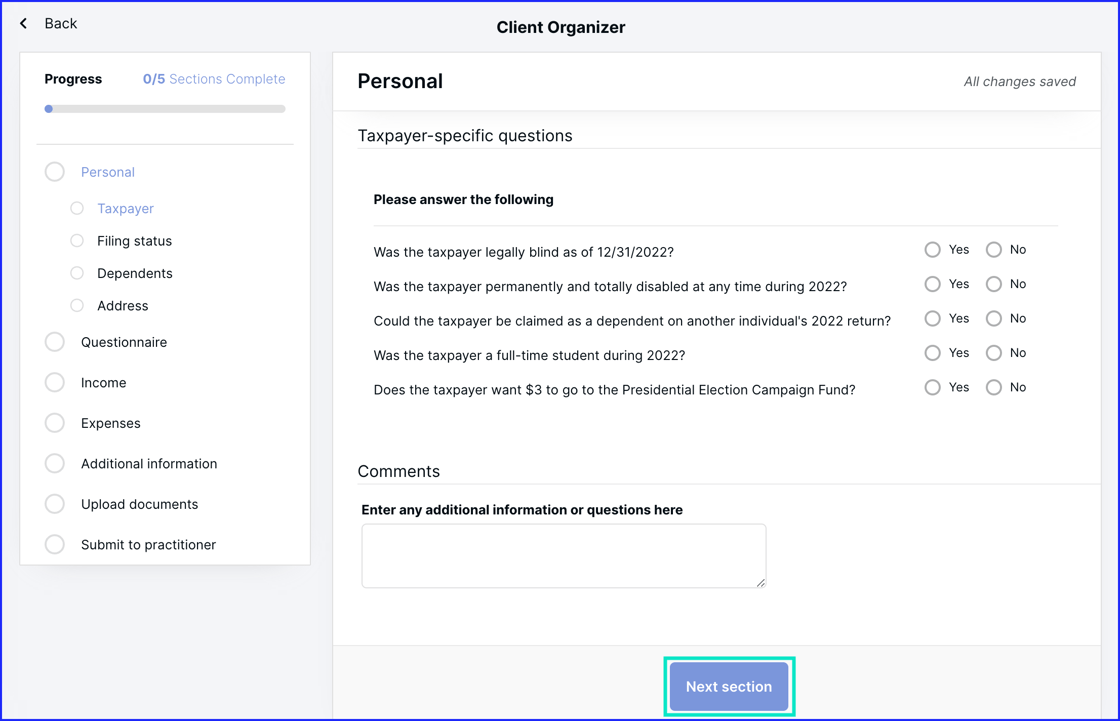

Next Check Off any required boxes and fill out all required information on the organizer. Click Next section to proceed to the next section of the organizer.

We have included what the Personal looks like first, and Business second

|

|

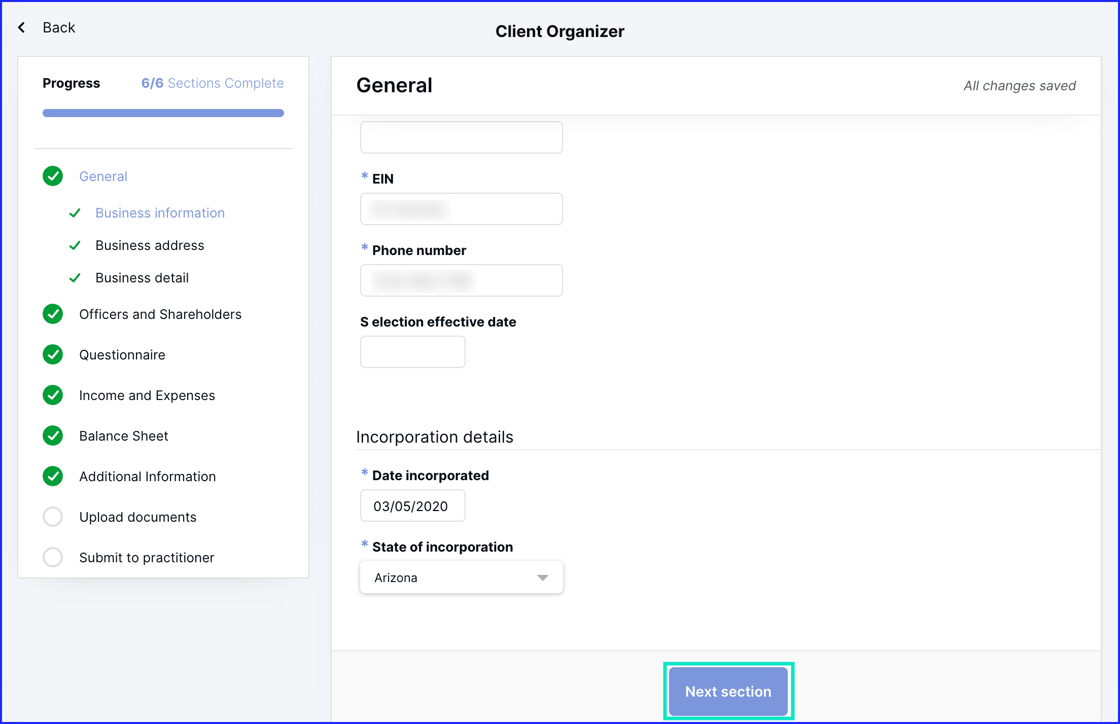

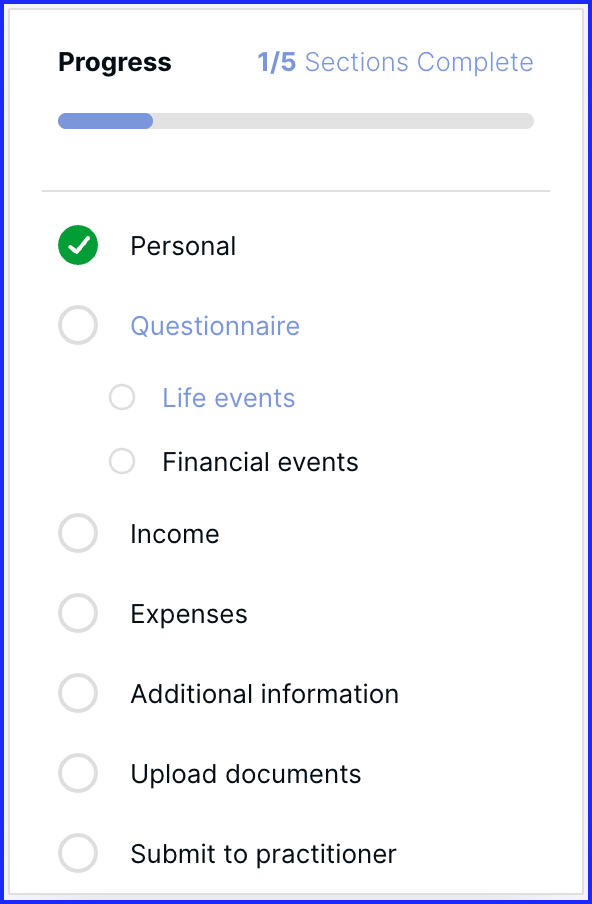

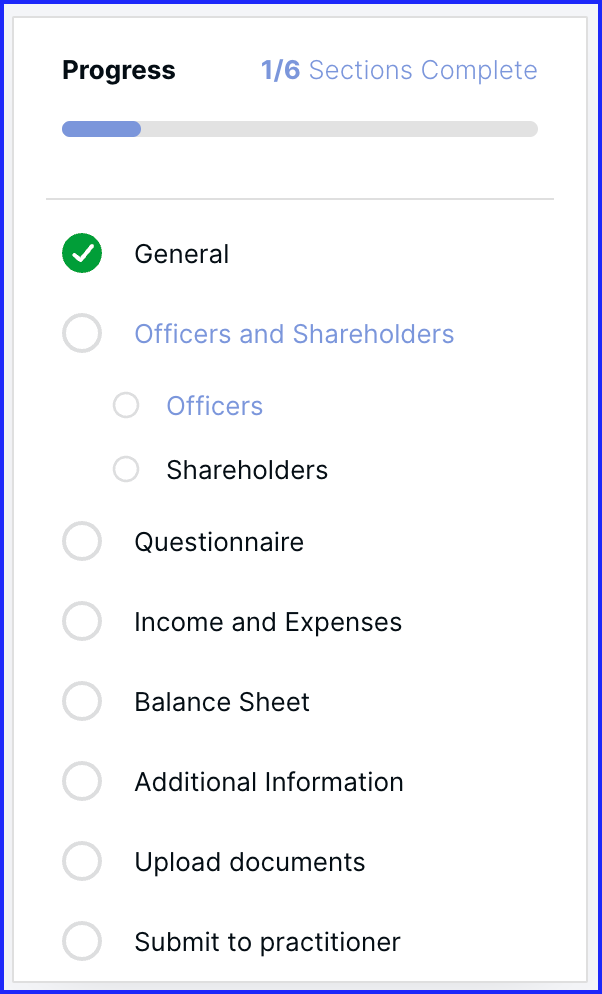

Next, complete each section of the Organizer and view your progress in the Progress box.

We have included what the Personal looks like first, and Business second

|

|

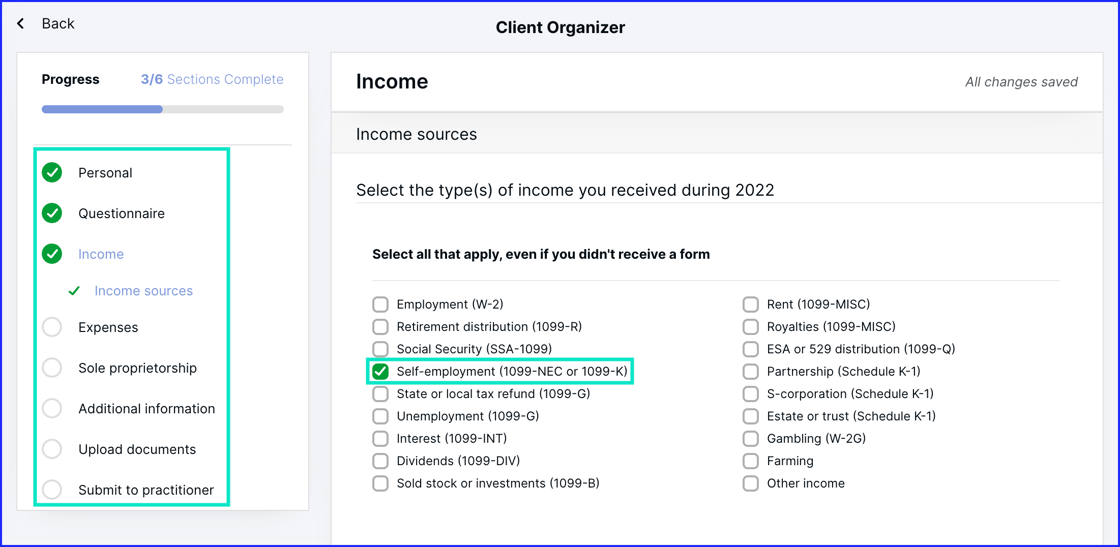

One special note for those completing organizers who are self-employed. If you are a sole proprietor (filing Schedule C), ensure that the "Self-employment (1099-NEC or 1099-K)" box is checked under the Questionnaire > Income sources section. Once that is checked, you will be able to enter your business information in the Sole proprietorship section.

|

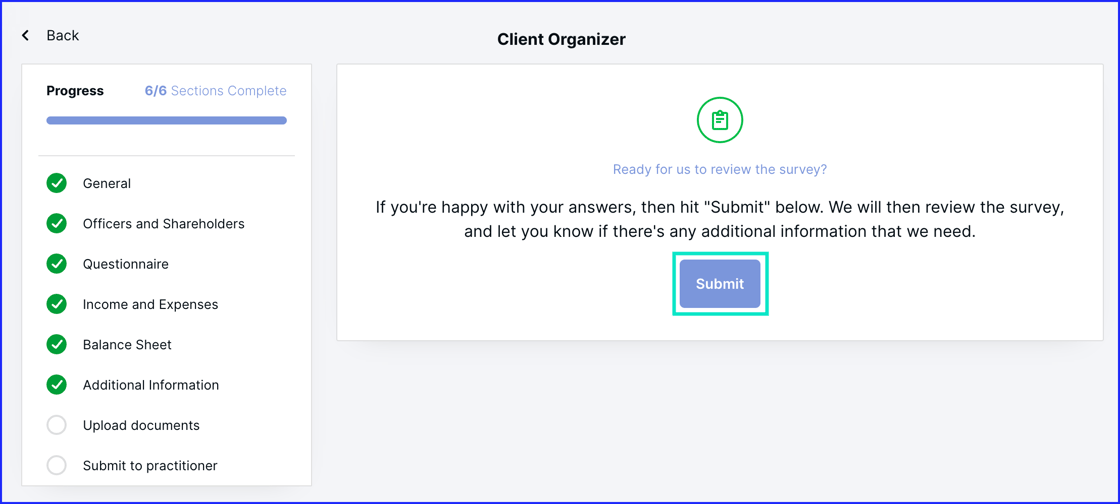

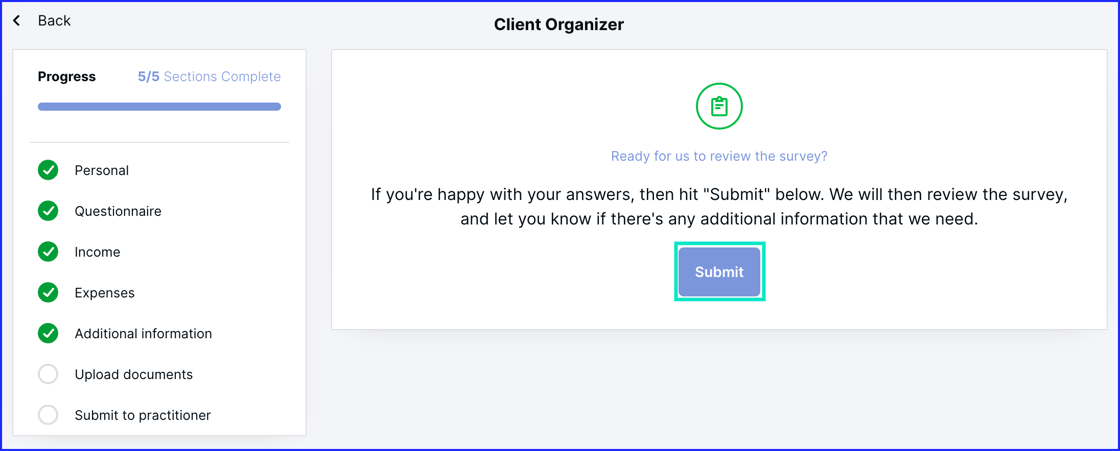

Once your organizer is completed, and you have attached any relevant tax documents, click Submit.

We have included what the Personal looks like first, and Business second.

|

|

|

That's it.

Your Organizer is now ready to be reviewed by your accountant.

I’m Kristin, the PWCPA PC Customer Success Specialist. For more information about this topic, or any other, you can always reach me through our customer ticketing system.