If you filed online, you will be able to get a status update in about 24 hours. If you mailed in your tax paperwork, you can expect to get an update in about 30 days.

Checking your status is quick and easy to do using the IRS

Below is a video that walks you through the steps of checking your status online.

Checking Your Federal Return Status Is Easy To Do. Follow These Steps. - Watch Video

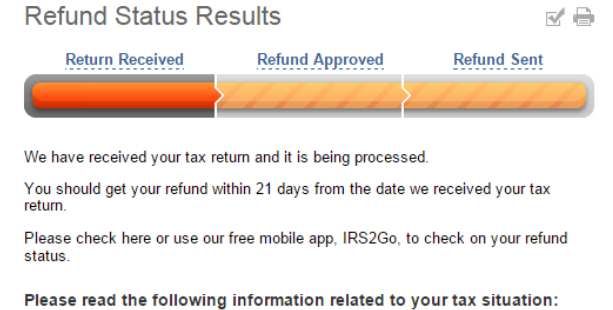

If there is an update to your status, you will be taken to this screen:

Note: If your refund amount was reduced for any reason i.e. you owed back taxes for a previous year, the IRS will let you know on this screen.

Note: If your refund amount was reduced for any reason i.e. you owed back taxes for a previous year, the IRS will let you know on this screen.

Return Received means your return has been received and will be processed, this can take about 21 business days.

Refund Approved means your refund has been processed and approved.

Refund Sent means your refund has been sent to you by the IRS either by direct deposit or mail. The amount of time it takes for the money to hit your bank account will depend on your own financial institution, and checks can be delayed by mail depending on your location. If you paper filed, you should expect to receive your refund check by mail in about six weeks.

At Peter Witts CPA PC we look forward to helping you file a stress free return.

I’m Kristin, the PWCPA PC Customer Success Specialist. For more information about this topic, or any other, you can always reach me through our customer ticketing system.