Simply put: A tax credit reduces the amount of tax you owe dollar for dollar. A tax deduction reduces the amount of income that you are taxed on. Read on for more.

It is easy to confuse the terms tax credits and tax deductions when you hear them because you know that they both lower the amount of taxes you owe.

A tax credit reduces the amount of tax you owe dollar for dollar.

A tax deduction reduces the amount of income that you are taxed on.

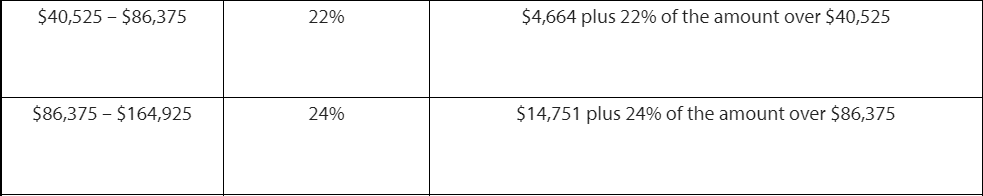

Let's say you made $86,375.01 a year in the 24% tax bracket and owed $14,751 in taxes.

A tax credit of $5000 would mean you now owed $9751 in taxes.

A tax deduction of $5000 would mean you are now being taxed on an income of $81,375.01, it drops you to the next lower tax bracket of $22% and your tax bill would be $13651.

Both the credit and the deduction reduce the amount you owe, but in very different ways.

INCOME TAX BRACKET TAXES OWED

Maximize your tax benefits with Peter Witts CPA PC! Trust our experienced professionals to answer all of your tax questions, and provide expert, comprehensive tax solutions.

I’m Kristin, the PWCPA PC Customer Success Specialist. For more information about this topic, or any other, you can always reach me through our customer ticketing system.